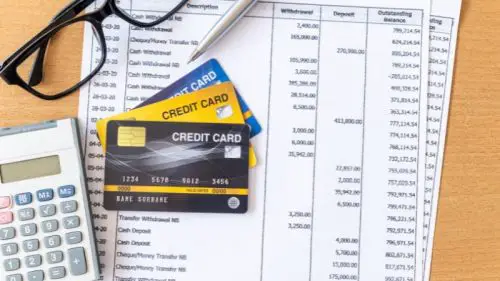

Inflation could be a common financial wonder that influences individuals, businesses, and whole economies. Whereas it could appear like an unique concept, its impact on your way of life is exceptionally genuine. In this article, we are going investigate what swelling is and how it dissolves the esteem of your cash over time.

What is Inflation?

Inflation is the rate at which the general level of prices for goods and services rises, resulting in a decrease in the purchasing power of a currency. In simpler terms, as inflation increases, each unit of currency buys fewer goods and services. It’s often expressed as an annual percentage.

The Erosion of Purchasing Power

One of the most significant ways inflation affects you is by eroding the purchasing power of your money. Let’s say you have $100 today, and the inflation rate is 2%. That means in a year, those same goods and services that cost $100 will cost $102. So, your $100 can buy slightly less than it could before.

Adjusting Financial Strategies

To combat the eroding effects of inflation, you may need to adjust your financial strategies:

- Invest Wisely: Consider investments that historically outpace inflation, such as stocks, real estate, or Treasury Inflation-Protected Securities (TIPS).

- Budget and Save: Create a budget that accounts for inflation, and save and invest accordingly. Avoid keeping all your assets in low-yield accounts.

- Diversify: Diversification can help spread risk and capture potential returns that outpace inflation.

- Consider TIPS: Treasury Inflation-Protected Securities are government bonds specifically designed to protect against inflation. They adjust with inflation and provide a guaranteed return above the rate of inflation.

- Review and Adjust: Regularly review your financial plan and adjust it as needed to keep up with changing economic conditions.